Accounts receivable management is a key part of keeping a business financially healthy. One important metric that helps measure efficiency in collecting receivables is BDSO, or Best Possible Days Sales Outstanding. What is BDSO? BDSO stands for Best Possible Days Sales Outstanding. It measures how quickly a company can collect receivables in an ideal situation… Continue reading BDSO and Its Impact on Cash Flow

Category: Finance

Embargo and Sanction: What They Mean and Who They Affect

Embargoes and sanctions are powerful tools that governments and international organizations use to influence or punish nations without resorting to armed conflict. Though the terms are sometimes used interchangeably, they describe different approaches with shared goals: to change behavior, uphold global norms, and protect national interests. An embargo is like a total blackout. One nation,… Continue reading Embargo and Sanction: What They Mean and Who They Affect

Why Germany Is Still Struggling with Digitalization – A Real-Life Look from Finance

Working in Germany, especially in a field like Finance, often feels like stepping into a strange paradox. On one hand, you’re in one of the most advanced economies in the world—known for its precision, engineering, and efficiency. On the other hand, daily tasks can feel like they belong in the 1990s. If you’ve ever had… Continue reading Why Germany Is Still Struggling with Digitalization – A Real-Life Look from Finance

Cash Against Documents: A Practical Tool for Global Trade

In international trade, doing business across borders brings both opportunity and risk. One of the biggest concerns for exporters is getting paid, especially when dealing with buyers in new markets. At the same time, buyers don’t want to pay before goods are shipped. A practical solution that balances both sides is Cash Against Documents (CAD).… Continue reading Cash Against Documents: A Practical Tool for Global Trade

Accounts Receivable vs Accounts Payable: Key Differences

When it comes to understanding how a business manages its money, two essential terms often pop up: accounts receivable and accounts payable. These are basic, yet powerful parts of financial management that every business, no matter the size, deals with regularly. While they might sound similar at first, they actually represent opposite sides of a… Continue reading Accounts Receivable vs Accounts Payable: Key Differences

SBR vs ABR: How Strategic and Annual Business Reviews Drive Your Company Forward

When you’re running or managing a business, there’s a constant need to check how things are going, whether you’re moving in the right direction, and what you should do next. Business reviews help with exactly that. But not all reviews are the same. You may have heard terms like SBR (Strategic Business Review), ABR (Annual… Continue reading SBR vs ABR: How Strategic and Annual Business Reviews Drive Your Company Forward

Why Payments Are Always Late in Europe’s Healthcare System

If you’ve ever worked with public hospitals, clinics, pharmacies, or distributors in Europe, you’ve probably asked yourself one simple question: why does it always take so long to get paid? It’s a common frustration. Invoices stretch out for months, reminders go unanswered, and there’s always some excuse. But the reasons behind these delays are more… Continue reading Why Payments Are Always Late in Europe’s Healthcare System

Tenders for Public Hospitals: Why They’re Essential and How They Work

Tenders play a crucial role in the way public hospitals operate, even though the term might sound bureaucratic or complex. Simply put, a tender is an official offer made by suppliers or service providers to deliver goods, services, or carry out work at a specific price. When it comes to public hospitals, tenders are a… Continue reading Tenders for Public Hospitals: Why They’re Essential and How They Work

Credit Limits in the Healthcare Supply Chain: Protecting Cash Flow Without Disrupting Care

In the world of healthcare supply, credit is not just a financial tool—it’s often a lifeline. Suppliers provide critical medical products to a wide range of customers: public hospitals, private clinics, retail pharmacies, wholesalers, and distributors. Many of these buyers depend on credit terms to manage their cash flow, especially in systems where reimbursements are… Continue reading Credit Limits in the Healthcare Supply Chain: Protecting Cash Flow Without Disrupting Care

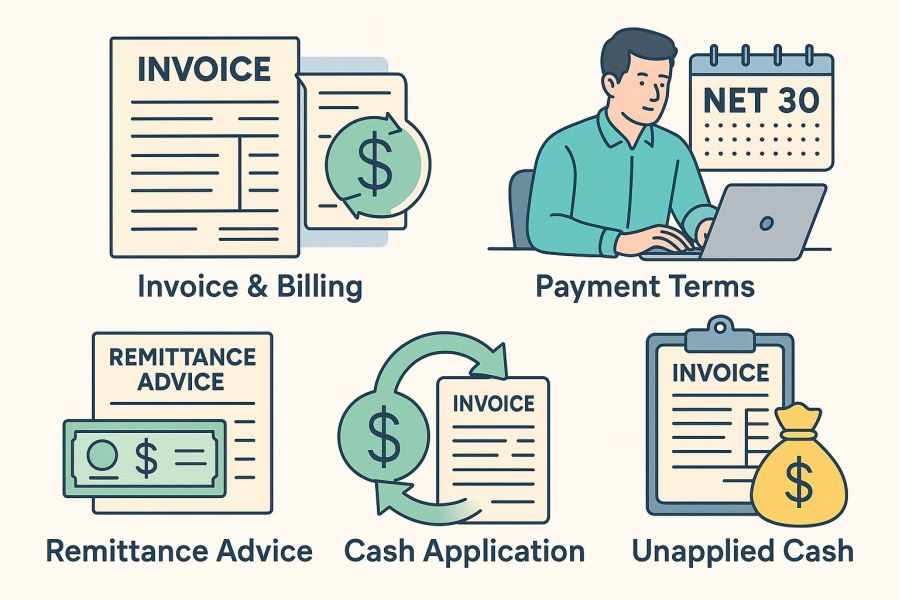

Unapplied Cash: Why It Matters and How to Handle It

Behind the numbers and spreadsheets of everyday business, unapplied cash is a quiet disruptor that often goes unnoticed until it starts creating real problems. It’s not as visible as unpaid invoices or as flashy as revenue milestones, but it’s an area that deserves attention. Understanding unapplied cash and taking steps to reduce or clear it… Continue reading Unapplied Cash: Why It Matters and How to Handle It

Understanding Invoices, Billing, and Payment Terms: A Simple Guide to Getting Paid Right

If you’ve ever sold a product or service, you already know how important it is to get paid on time. But when money is involved, there’s more than just sending a bill and hoping it gets paid. Behind every successful business transaction, there’s a system that keeps things organized, clear, and traceable. This system lives… Continue reading Understanding Invoices, Billing, and Payment Terms: A Simple Guide to Getting Paid Right

Understanding Write-Offs and Write-Ons

In the world of finance and accounting, a lot of terms sound more intimidating than they actually are. “Write-off” and “write-on” are two of those phrases that tend to confuse people at first glance, but once you break them down, they’re pretty straightforward. They’re important tools for managing the accuracy of financial records, and they… Continue reading Understanding Write-Offs and Write-Ons

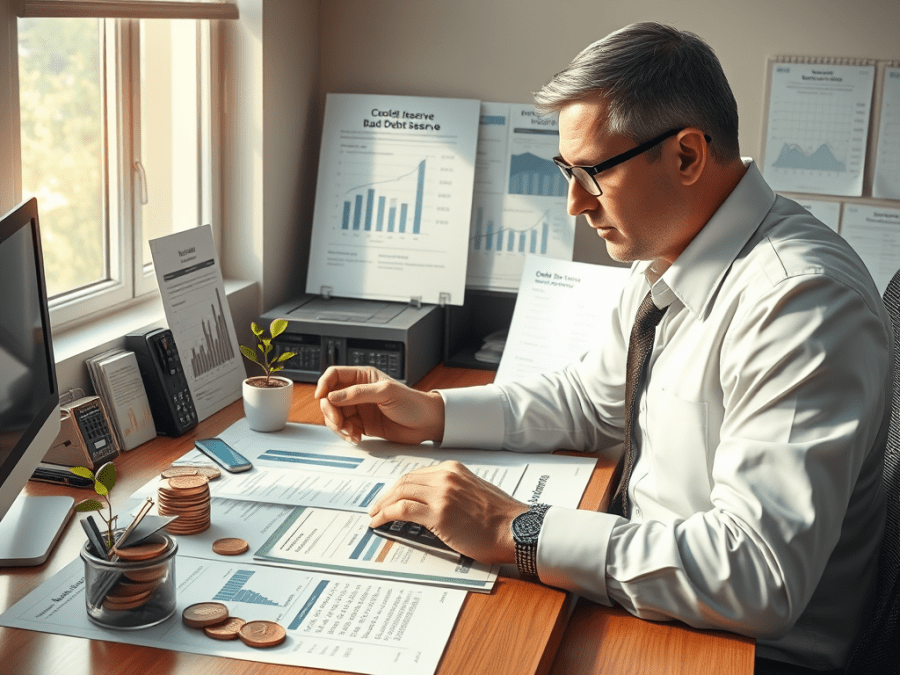

What Is a Bad Debt Reserve and Why It’s Important for Businesses

In the world of business, not every sale turns into cash. As much as we’d like to believe that every customer will pay on time, or at all, reality often proves otherwise. This is where the concept of the bad debt reserve comes into play. It’s a critical accounting practice that many companies use, but… Continue reading What Is a Bad Debt Reserve and Why It’s Important for Businesses

The Hidden Power of Accrual: Why It’s the Unsung Hero of Good Accounting

If you’ve ever peeked into the world of accounting, chances are you’ve heard the word “accrual” thrown around. Maybe it sounded complicated, overly technical, or like something only big corporations worry about. But here’s the thing: accruals aren’t just accounting jargon. They’re actually one of the most important tools for making sure your financial records… Continue reading The Hidden Power of Accrual: Why It’s the Unsung Hero of Good Accounting

Understanding Cash Flow: What It Means and How It Affects Everyone in Business

Cash flow might sound like a technical finance term reserved for accountants and analysts, but in truth, it’s something every business owner, manager, or supplier experiences every day. Whether you run a neighborhood bakery, a mid-sized construction company, or a multinational corporation, cash flow plays a huge role in how your business survives and grows.… Continue reading Understanding Cash Flow: What It Means and How It Affects Everyone in Business

Verification of Payee: The EU’s New Rule That Will Make Payments Safer by 2025

Digital payments are fast, easy, and convenient—but they’re not foolproof. Every year, thousands of people across Europe lose money to fraud or simple banking errors, often because of one tiny detail: the wrong name on a bank account. To solve this, the European Union is rolling out a powerful new regulation: Verification of Payee (VoP).… Continue reading Verification of Payee: The EU’s New Rule That Will Make Payments Safer by 2025

MBR and QBR: Understanding Their Role in Business Success

In the business world, companies constantly strive to improve performance, maintain client relationships, and ensure strategic growth. Two critical processes that help achieve these goals are the Monthly Business Review (MBR) and the Quarterly Business Review (QBR). These structured review meetings provide insights into business operations, help track progress, and foster stronger relationships between internal… Continue reading MBR and QBR: Understanding Their Role in Business Success

Understanding the Different Levels of Refund Requests to Suppliers in France

When businesses in France deal with suppliers, they may find themselves in a position where they are owed money due to credit notes, returns, overpayments, or other outstanding balances. Requesting refunds from suppliers is a structured process that follows different levels, depending on the circumstances. In this article, we will explore the various types of… Continue reading Understanding the Different Levels of Refund Requests to Suppliers in France

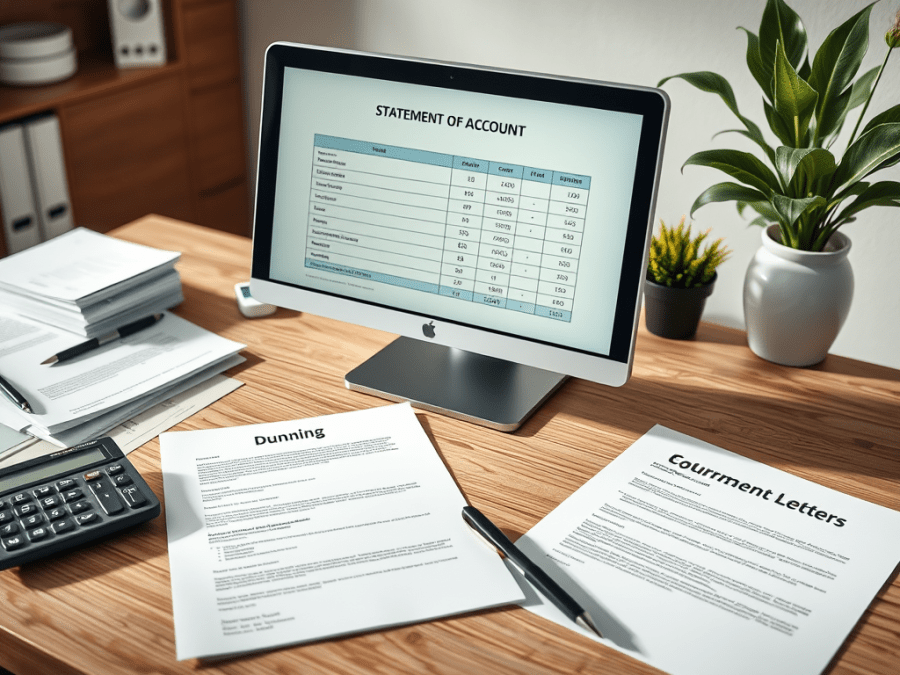

The Importance of Statements of Account and Dunning Letters in Business

Managing customer payments efficiently is a crucial part of running a successful business. Late or missed payments can disrupt cash flow, affect profitability, and create unnecessary financial strain. Two important tools that businesses use to manage receivables are statements of account and dunning letters. These tools help companies maintain transparency, remind customers of outstanding invoices,… Continue reading The Importance of Statements of Account and Dunning Letters in Business

Mastering MBR for Collections Teams: Strengthening Internal and Client Collaboration

In the world of collections, managing overdue invoices is not just about sending reminders or making calls. It requires a structured approach, clear communication, and continuous performance tracking. One of the most effective tools for ensuring efficiency in collections is the Monthly Business Review (MBR). An MBR serves two critical functions: A well-executed MBR ensures… Continue reading Mastering MBR for Collections Teams: Strengthening Internal and Client Collaboration

The Power of Monthly Business Reviews in Order-to-Cash Services

Running a smooth and efficient order-to-cash (O2C) process is crucial for any service provider handling transactions on behalf of a client. In industries like pharmaceuticals and medtech, where compliance, accuracy, and timeliness are non-negotiable, ensuring that everything runs seamlessly is even more critical. That’s where the Monthly Business Review (MBR) becomes an essential tool. It… Continue reading The Power of Monthly Business Reviews in Order-to-Cash Services

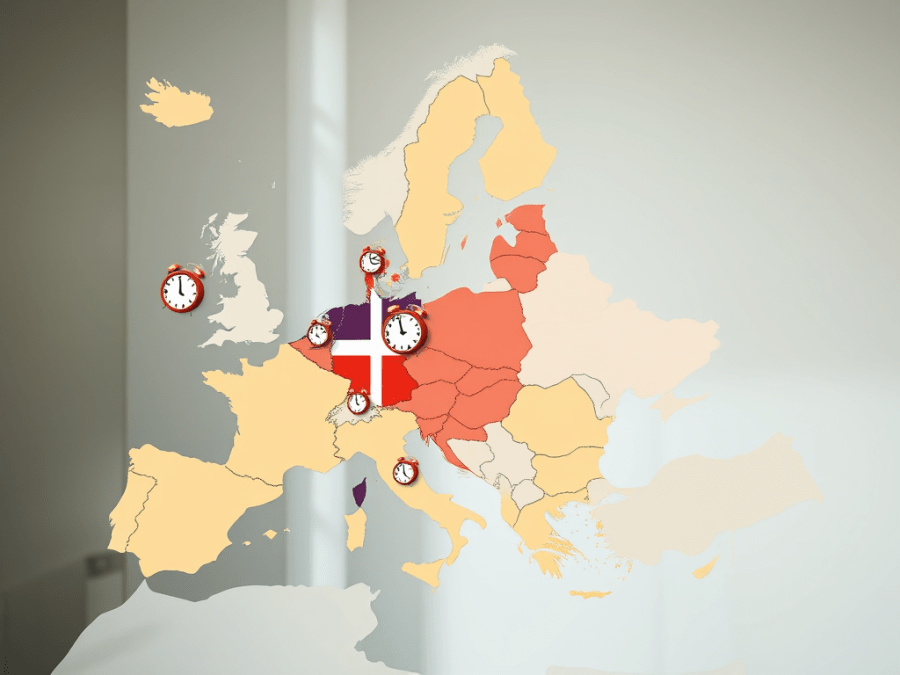

Understanding Payment Terms and Their Importance in Europe

Payment terms define the agreed-upon time frame within which a buyer must pay a seller for goods or services. These terms are crucial in business transactions because they directly impact cash flow, financial stability, and supplier relationships. Payment terms vary across industries and countries, influenced by local business culture, economic conditions, and legal frameworks. Having… Continue reading Understanding Payment Terms and Their Importance in Europe

Understanding Average Days Delinquent (ADD): A Key to Healthier Receivables

Every business that sends out invoices wants to get paid on time. But in reality, customers don’t always stick to the due dates. Some pay late by a few days, others by weeks, and in some cases, even months. To keep track of how far past the due date your payments are arriving, there’s a… Continue reading Understanding Average Days Delinquent (ADD): A Key to Healthier Receivables

Optimizing Cash Flow: The Impact of Setting the Right Payment Terms on DSO

Cash flow is the heartbeat of any business. Without enough cash coming in at the right time, even a profitable company can run into trouble. That’s why managing how quickly customers pay—also known as Days Sales Outstanding, or DSO—is so important. DSO tells you how many days, on average, it takes to collect payment after… Continue reading Optimizing Cash Flow: The Impact of Setting the Right Payment Terms on DSO

Factors Influencing Longer DSO

Several factors can contribute to longer Days Sales Outstanding (DSO), indicating delayed payment collection for a business. Here are the key factors: 1. Extended Payment Terms: Offering customers longer payment terms can naturally lead to a prolonged collection period. While this may be a strategic decision, it also increases the DSO. 2. Inefficient Invoicing: Delays… Continue reading Factors Influencing Longer DSO

Understanding DSO and Its Impact on Accounts Receivable Collections

Daily Sales Outstanding (DSO) is an important financial metric that shows how long it takes for a company to collect payments after making a sale. It measures the average number of days it takes for invoices to be paid. A lower DSO means faster collections, while a higher DSO indicates delayed payments. For businesses managing… Continue reading Understanding DSO and Its Impact on Accounts Receivable Collections

Understanding Accounts Receivable and the Art of Timely Collections

Accounts receivable (AR) refers to the money a company is owed by its customers for goods or services that have already been delivered but not yet paid for. It represents outstanding invoices that a business expects to collect within a specific time frame. Efficient AR management is critical because delayed payments can cause cash flow… Continue reading Understanding Accounts Receivable and the Art of Timely Collections

Understanding Incoterms: A Guide to International Trade Rules

When businesses buy and sell goods internationally, they need clear rules to define who is responsible for transportation, insurance, customs duties, and potential risks. This is where Incoterms (International Commercial Terms) come in. These standardized trade terms, established by the International Chamber of Commerce (ICC), help buyers and sellers avoid confusion by clearly outlining their… Continue reading Understanding Incoterms: A Guide to International Trade Rules