In international trade, doing business across borders brings both opportunity and risk. One of the biggest concerns for exporters is getting paid, especially when dealing with buyers in new markets. At the same time, buyers don’t want to pay before goods are shipped. A practical solution that balances both sides is Cash Against Documents (CAD).… Continue reading Cash Against Documents: A Practical Tool for Global Trade

Tag: Payment Terms

Letters of Credit: A Lifeline for Global Trade

In the global economy, international trade is both an opportunity and a challenge. Opportunities come in the form of expanding markets, diversifying customer bases, and boosting profits. The challenges, however, lie in distance, regulations, currency differences, and most importantly, trust. One of the most effective tools used to bridge that trust gap is the letter… Continue reading Letters of Credit: A Lifeline for Global Trade

Accounts Receivable vs Accounts Payable: Key Differences

When it comes to understanding how a business manages its money, two essential terms often pop up: accounts receivable and accounts payable. These are basic, yet powerful parts of financial management that every business, no matter the size, deals with regularly. While they might sound similar at first, they actually represent opposite sides of a… Continue reading Accounts Receivable vs Accounts Payable: Key Differences

Credit Limits in the Healthcare Supply Chain: Protecting Cash Flow Without Disrupting Care

In the world of healthcare supply, credit is not just a financial tool—it’s often a lifeline. Suppliers provide critical medical products to a wide range of customers: public hospitals, private clinics, retail pharmacies, wholesalers, and distributors. Many of these buyers depend on credit terms to manage their cash flow, especially in systems where reimbursements are… Continue reading Credit Limits in the Healthcare Supply Chain: Protecting Cash Flow Without Disrupting Care

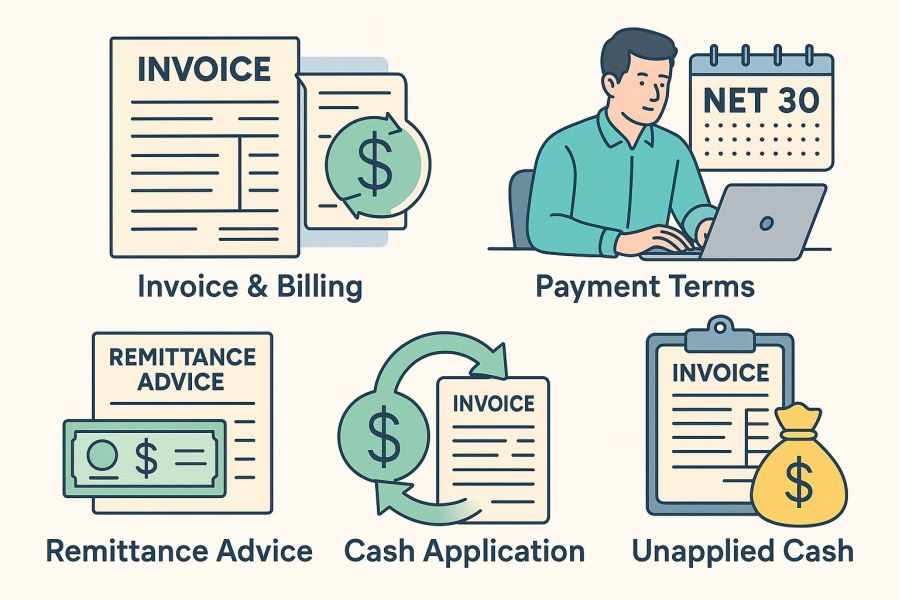

Understanding Invoices, Billing, and Payment Terms: A Simple Guide to Getting Paid Right

If you’ve ever sold a product or service, you already know how important it is to get paid on time. But when money is involved, there’s more than just sending a bill and hoping it gets paid. Behind every successful business transaction, there’s a system that keeps things organized, clear, and traceable. This system lives… Continue reading Understanding Invoices, Billing, and Payment Terms: A Simple Guide to Getting Paid Right

Understanding Cash Flow: What It Means and How It Affects Everyone in Business

Cash flow might sound like a technical finance term reserved for accountants and analysts, but in truth, it’s something every business owner, manager, or supplier experiences every day. Whether you run a neighborhood bakery, a mid-sized construction company, or a multinational corporation, cash flow plays a huge role in how your business survives and grows.… Continue reading Understanding Cash Flow: What It Means and How It Affects Everyone in Business

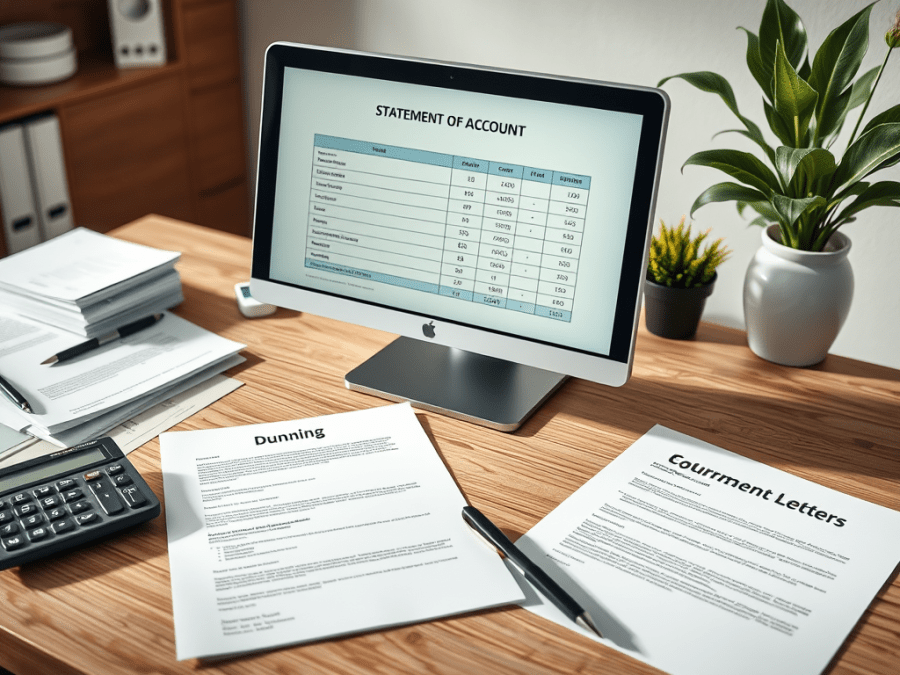

The Importance of Statements of Account and Dunning Letters in Business

Managing customer payments efficiently is a crucial part of running a successful business. Late or missed payments can disrupt cash flow, affect profitability, and create unnecessary financial strain. Two important tools that businesses use to manage receivables are statements of account and dunning letters. These tools help companies maintain transparency, remind customers of outstanding invoices,… Continue reading The Importance of Statements of Account and Dunning Letters in Business

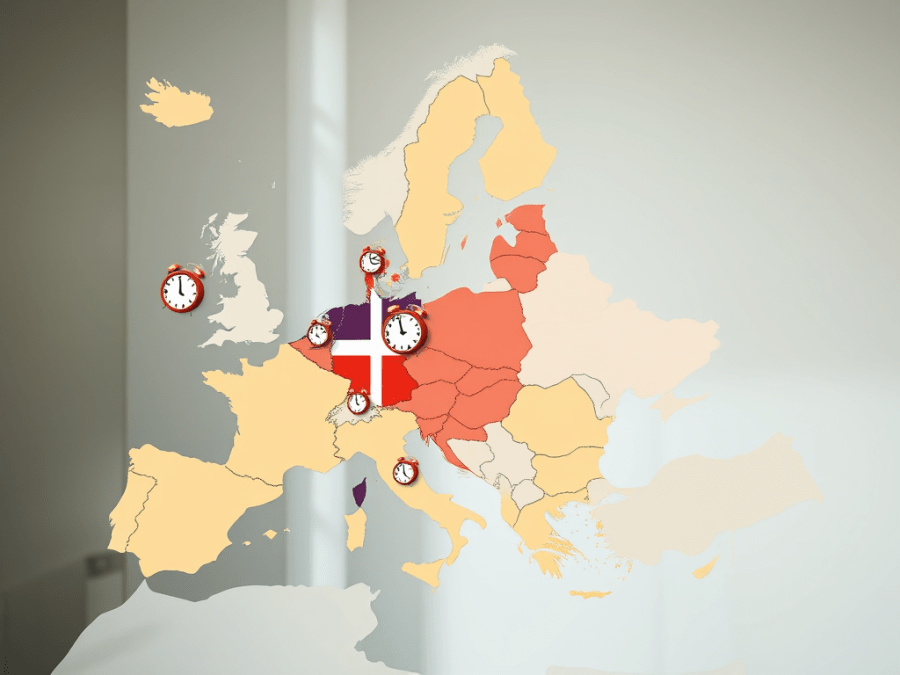

Understanding Payment Terms and Their Importance in Europe

Payment terms define the agreed-upon time frame within which a buyer must pay a seller for goods or services. These terms are crucial in business transactions because they directly impact cash flow, financial stability, and supplier relationships. Payment terms vary across industries and countries, influenced by local business culture, economic conditions, and legal frameworks. Having… Continue reading Understanding Payment Terms and Their Importance in Europe

Understanding Average Days Delinquent (ADD): A Key to Healthier Receivables

Every business that sends out invoices wants to get paid on time. But in reality, customers don’t always stick to the due dates. Some pay late by a few days, others by weeks, and in some cases, even months. To keep track of how far past the due date your payments are arriving, there’s a… Continue reading Understanding Average Days Delinquent (ADD): A Key to Healthier Receivables

Optimizing Cash Flow: The Impact of Setting the Right Payment Terms on DSO

Cash flow is the heartbeat of any business. Without enough cash coming in at the right time, even a profitable company can run into trouble. That’s why managing how quickly customers pay—also known as Days Sales Outstanding, or DSO—is so important. DSO tells you how many days, on average, it takes to collect payment after… Continue reading Optimizing Cash Flow: The Impact of Setting the Right Payment Terms on DSO