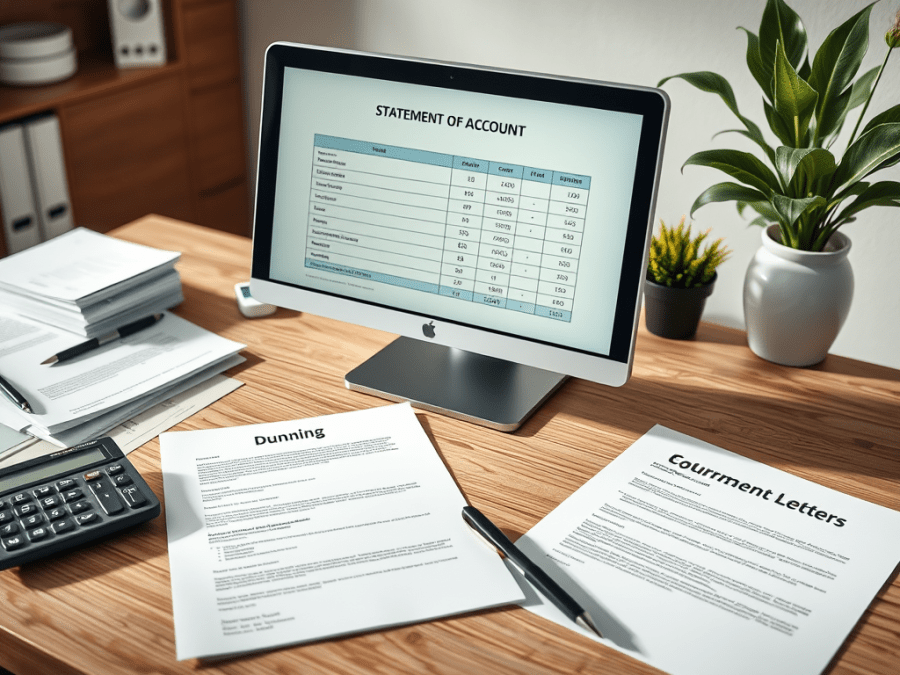

Managing customer payments efficiently is a crucial part of running a successful business. Late or missed payments can disrupt cash flow, affect profitability, and create unnecessary financial strain. Two important tools that businesses use to manage receivables are statements of account and dunning letters. These tools help companies maintain transparency, remind customers of outstanding invoices,… Continue reading The Importance of Statements of Account and Dunning Letters in Business

Tag: overdue payments

Understanding DSO and Its Impact on Accounts Receivable Collections

Daily Sales Outstanding (DSO) is an important financial metric that shows how long it takes for a company to collect payments after making a sale. It measures the average number of days it takes for invoices to be paid. A lower DSO means faster collections, while a higher DSO indicates delayed payments. For businesses managing… Continue reading Understanding DSO and Its Impact on Accounts Receivable Collections

Understanding Accounts Receivable and the Art of Timely Collections

Accounts receivable (AR) refers to the money a company is owed by its customers for goods or services that have already been delivered but not yet paid for. It represents outstanding invoices that a business expects to collect within a specific time frame. Efficient AR management is critical because delayed payments can cause cash flow… Continue reading Understanding Accounts Receivable and the Art of Timely Collections