If you’ve ever worked with public hospitals, clinics, pharmacies, or distributors in Europe, you’ve probably asked yourself one simple question: why does it always take so long to get paid? It’s a common frustration. Invoices stretch out for months, reminders go unanswered, and there’s always some excuse. But the reasons behind these delays are more… Continue reading Why Payments Are Always Late in Europe’s Healthcare System

Tag: Late Payments

What Is a Bad Debt Reserve and Why It’s Important for Businesses

In the world of business, not every sale turns into cash. As much as we’d like to believe that every customer will pay on time, or at all, reality often proves otherwise. This is where the concept of the bad debt reserve comes into play. It’s a critical accounting practice that many companies use, but… Continue reading What Is a Bad Debt Reserve and Why It’s Important for Businesses

Understanding Cash Flow: What It Means and How It Affects Everyone in Business

Cash flow might sound like a technical finance term reserved for accountants and analysts, but in truth, it’s something every business owner, manager, or supplier experiences every day. Whether you run a neighborhood bakery, a mid-sized construction company, or a multinational corporation, cash flow plays a huge role in how your business survives and grows.… Continue reading Understanding Cash Flow: What It Means and How It Affects Everyone in Business

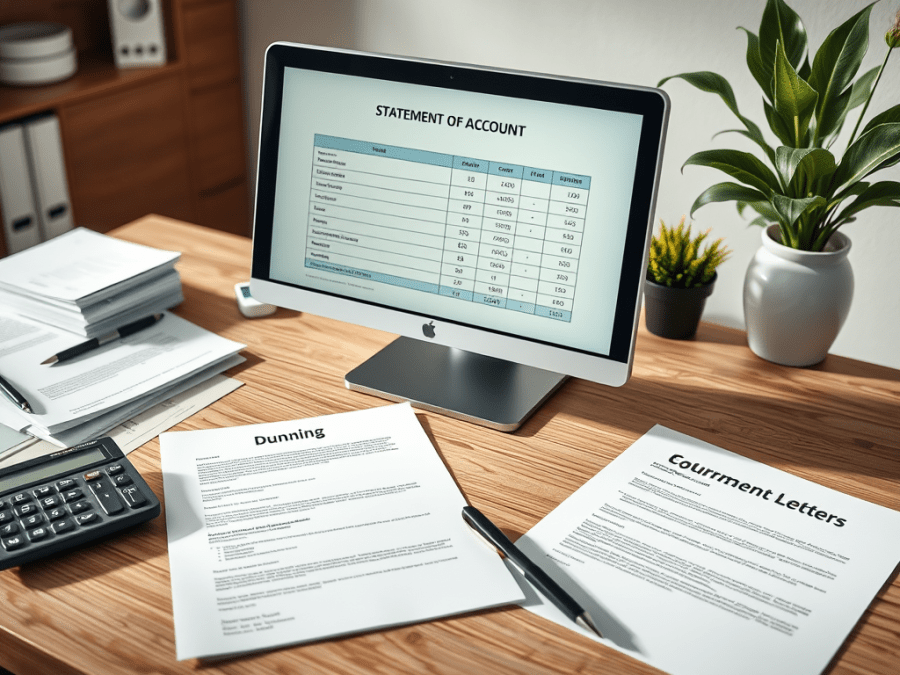

The Importance of Statements of Account and Dunning Letters in Business

Managing customer payments efficiently is a crucial part of running a successful business. Late or missed payments can disrupt cash flow, affect profitability, and create unnecessary financial strain. Two important tools that businesses use to manage receivables are statements of account and dunning letters. These tools help companies maintain transparency, remind customers of outstanding invoices,… Continue reading The Importance of Statements of Account and Dunning Letters in Business

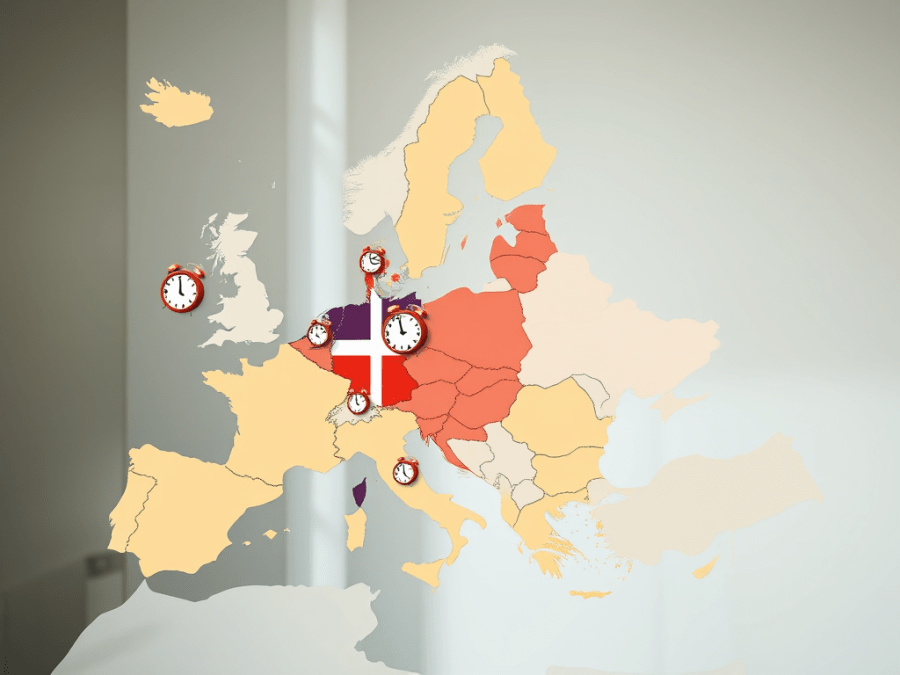

Understanding Payment Terms and Their Importance in Europe

Payment terms define the agreed-upon time frame within which a buyer must pay a seller for goods or services. These terms are crucial in business transactions because they directly impact cash flow, financial stability, and supplier relationships. Payment terms vary across industries and countries, influenced by local business culture, economic conditions, and legal frameworks. Having… Continue reading Understanding Payment Terms and Their Importance in Europe

Understanding Average Days Delinquent (ADD): A Key to Healthier Receivables

Every business that sends out invoices wants to get paid on time. But in reality, customers don’t always stick to the due dates. Some pay late by a few days, others by weeks, and in some cases, even months. To keep track of how far past the due date your payments are arriving, there’s a… Continue reading Understanding Average Days Delinquent (ADD): A Key to Healthier Receivables