Accounts receivable management is a key part of keeping a business financially healthy. One important metric that helps measure efficiency in collecting receivables is BDSO, or Best Possible Days Sales Outstanding. What is BDSO? BDSO stands for Best Possible Days Sales Outstanding. It measures how quickly a company can collect receivables in an ideal situation… Continue reading BDSO and Its Impact on Cash Flow

Tag: Accounts Receivable

Accounts Receivable vs Accounts Payable: Key Differences

When it comes to understanding how a business manages its money, two essential terms often pop up: accounts receivable and accounts payable. These are basic, yet powerful parts of financial management that every business, no matter the size, deals with regularly. While they might sound similar at first, they actually represent opposite sides of a… Continue reading Accounts Receivable vs Accounts Payable: Key Differences

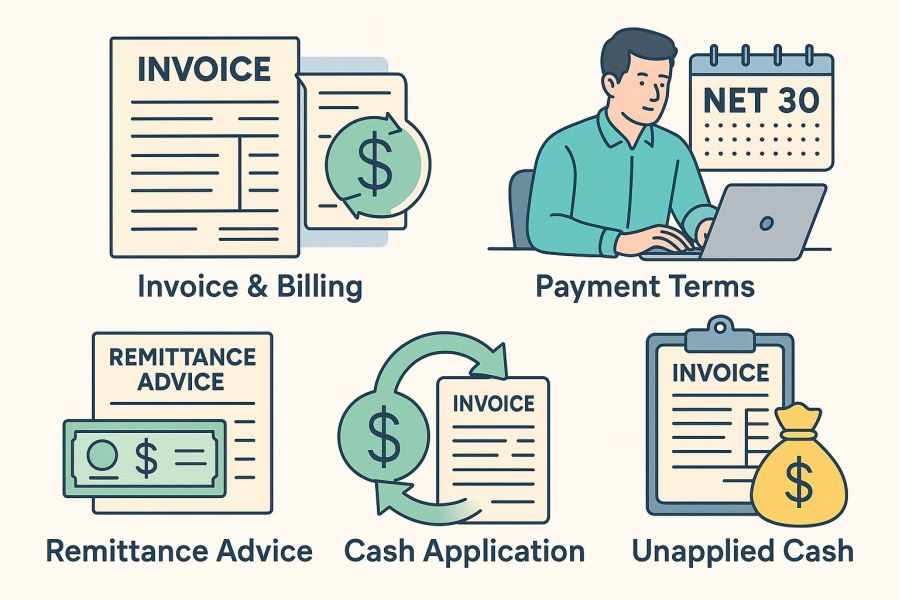

Unapplied Cash: Why It Matters and How to Handle It

Behind the numbers and spreadsheets of everyday business, unapplied cash is a quiet disruptor that often goes unnoticed until it starts creating real problems. It’s not as visible as unpaid invoices or as flashy as revenue milestones, but it’s an area that deserves attention. Understanding unapplied cash and taking steps to reduce or clear it… Continue reading Unapplied Cash: Why It Matters and How to Handle It

Understanding Invoices, Billing, and Payment Terms: A Simple Guide to Getting Paid Right

If you’ve ever sold a product or service, you already know how important it is to get paid on time. But when money is involved, there’s more than just sending a bill and hoping it gets paid. Behind every successful business transaction, there’s a system that keeps things organized, clear, and traceable. This system lives… Continue reading Understanding Invoices, Billing, and Payment Terms: A Simple Guide to Getting Paid Right

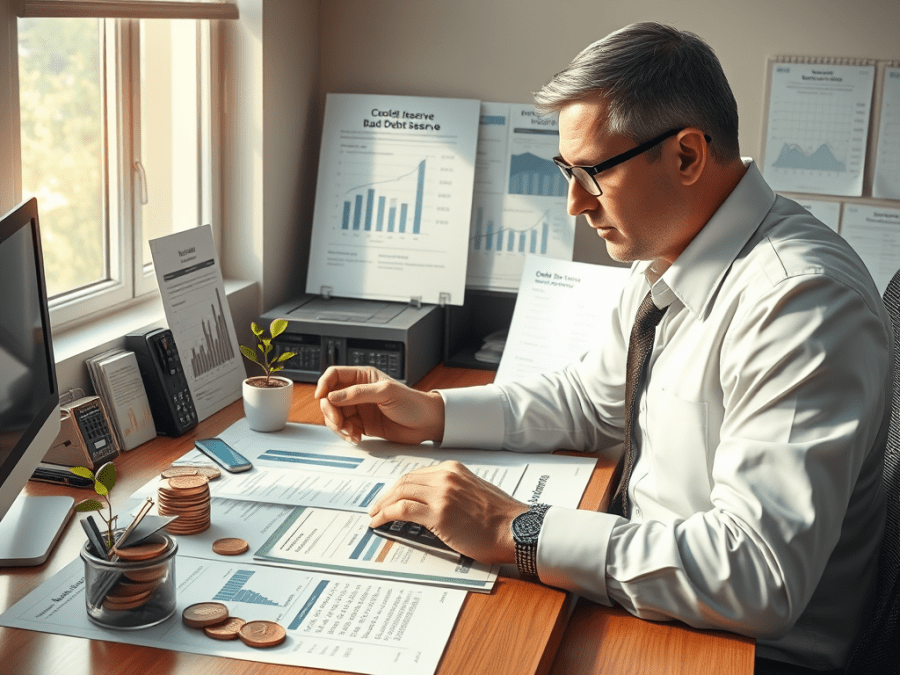

Understanding Write-Offs and Write-Ons

In the world of finance and accounting, a lot of terms sound more intimidating than they actually are. “Write-off” and “write-on” are two of those phrases that tend to confuse people at first glance, but once you break them down, they’re pretty straightforward. They’re important tools for managing the accuracy of financial records, and they… Continue reading Understanding Write-Offs and Write-Ons

What Is a Bad Debt Reserve and Why It’s Important for Businesses

In the world of business, not every sale turns into cash. As much as we’d like to believe that every customer will pay on time, or at all, reality often proves otherwise. This is where the concept of the bad debt reserve comes into play. It’s a critical accounting practice that many companies use, but… Continue reading What Is a Bad Debt Reserve and Why It’s Important for Businesses

Understanding Cash Flow: What It Means and How It Affects Everyone in Business

Cash flow might sound like a technical finance term reserved for accountants and analysts, but in truth, it’s something every business owner, manager, or supplier experiences every day. Whether you run a neighborhood bakery, a mid-sized construction company, or a multinational corporation, cash flow plays a huge role in how your business survives and grows.… Continue reading Understanding Cash Flow: What It Means and How It Affects Everyone in Business

Losing Myself in the Flow

There are moments when time disappears, and I find myself completely immersed in what I’m doing. It’s not a conscious effort; it just happens. The world around me fades, and the only thing that exists is the task at hand. I suppose that’s the essence of truly enjoying something—when it pulls you in so deeply… Continue reading Losing Myself in the Flow

The Importance of Statements of Account and Dunning Letters in Business

Managing customer payments efficiently is a crucial part of running a successful business. Late or missed payments can disrupt cash flow, affect profitability, and create unnecessary financial strain. Two important tools that businesses use to manage receivables are statements of account and dunning letters. These tools help companies maintain transparency, remind customers of outstanding invoices,… Continue reading The Importance of Statements of Account and Dunning Letters in Business

Mastering MBR for Collections Teams: Strengthening Internal and Client Collaboration

In the world of collections, managing overdue invoices is not just about sending reminders or making calls. It requires a structured approach, clear communication, and continuous performance tracking. One of the most effective tools for ensuring efficiency in collections is the Monthly Business Review (MBR). An MBR serves two critical functions: A well-executed MBR ensures… Continue reading Mastering MBR for Collections Teams: Strengthening Internal and Client Collaboration

Understanding Average Days Delinquent (ADD): A Key to Healthier Receivables

Every business that sends out invoices wants to get paid on time. But in reality, customers don’t always stick to the due dates. Some pay late by a few days, others by weeks, and in some cases, even months. To keep track of how far past the due date your payments are arriving, there’s a… Continue reading Understanding Average Days Delinquent (ADD): A Key to Healthier Receivables

Optimizing Cash Flow: The Impact of Setting the Right Payment Terms on DSO

Cash flow is the heartbeat of any business. Without enough cash coming in at the right time, even a profitable company can run into trouble. That’s why managing how quickly customers pay—also known as Days Sales Outstanding, or DSO—is so important. DSO tells you how many days, on average, it takes to collect payment after… Continue reading Optimizing Cash Flow: The Impact of Setting the Right Payment Terms on DSO

Understanding DSO and Its Impact on Accounts Receivable Collections

Daily Sales Outstanding (DSO) is an important financial metric that shows how long it takes for a company to collect payments after making a sale. It measures the average number of days it takes for invoices to be paid. A lower DSO means faster collections, while a higher DSO indicates delayed payments. For businesses managing… Continue reading Understanding DSO and Its Impact on Accounts Receivable Collections

Understanding Accounts Receivable and the Art of Timely Collections

Accounts receivable (AR) refers to the money a company is owed by its customers for goods or services that have already been delivered but not yet paid for. It represents outstanding invoices that a business expects to collect within a specific time frame. Efficient AR management is critical because delayed payments can cause cash flow… Continue reading Understanding Accounts Receivable and the Art of Timely Collections