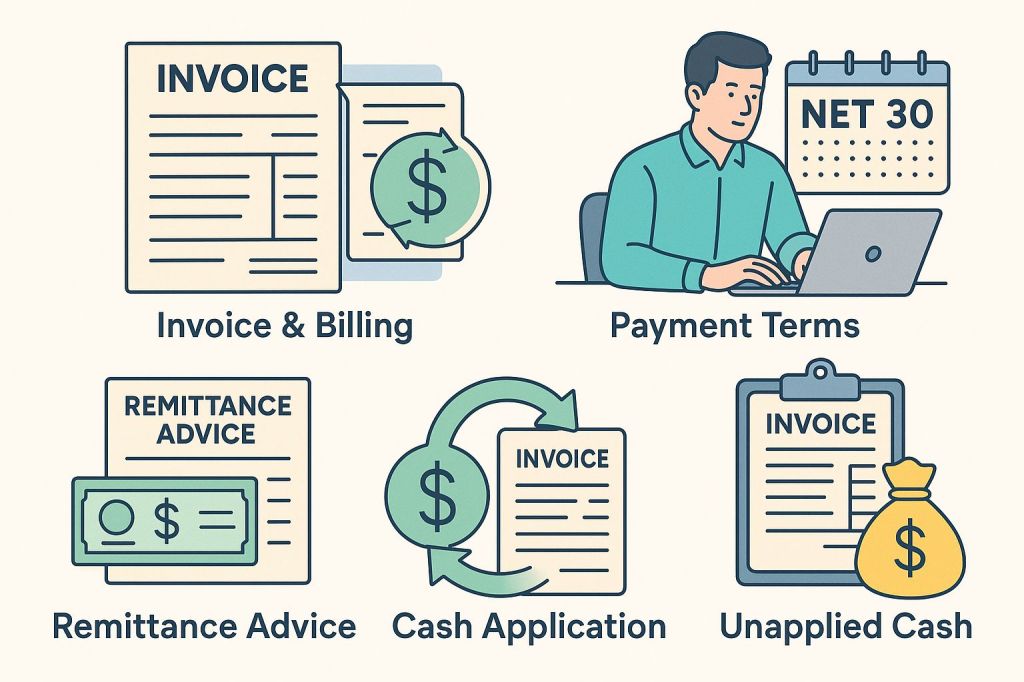

If you’ve ever sold a product or service, you already know how important it is to get paid on time. But when money is involved, there’s more than just sending a bill and hoping it gets paid. Behind every successful business transaction, there’s a system that keeps things organized, clear, and traceable. This system lives in a world full of terms like invoices, credit memos, remittance advice, cash application, and unapplied cash. These terms might sound complex at first, but they’re the key players in making sure the money you’ve earned ends up where it belongs: in your business account.

Let’s start with the most basic document in the billing process—the invoice. An invoice is a formal request for payment. When a company provides goods or services to a customer, it sends an invoice that shows how much is owed, what it’s for, and when the payment is due. Think of it as a polite but official way of saying, “Here’s what you owe me, and here’s how to pay it.” A well-prepared invoice typically includes the invoice number, the date it was issued, a breakdown of the items or services sold, unit prices, taxes if applicable, the total amount due, and payment terms.

Speaking of payment terms, those little phrases like “Net 30” or “Due Upon Receipt” are more important than they look. “Net 30” means the customer has 30 days from the invoice date to pay. If it says “Net 60,” then the customer has 60 days. These terms are not just random numbers—they’re agreements. Setting clear payment terms upfront helps both parties understand expectations and avoid confusion. For businesses, choosing the right terms can help manage cash flow effectively. Shorter terms can mean faster cash, but they might not be attractive to every customer. Longer terms might help close a deal, but they delay income. It’s all about balance.

Sometimes, after an invoice has been issued, something changes. Maybe a product was returned or a discount was given later. That’s where credit memos and debit memos come in. A credit memo reduces the amount the customer owes. If you overcharged someone or they returned something, you issue a credit memo, and that amount is subtracted from their balance. On the flip side, a debit memo is used when the amount due increases, like if you forgot to charge for shipping or added a late fee. These memos help keep the billing accurate and transparent.

Now let’s move a little further into the payment process. When the customer finally pays the invoice, how do you know which invoice they’re paying for? This is where remittance advice comes into play. It’s a document or a message from the customer, telling you exactly what the payment covers. Imagine receiving a lump sum of $10,000 from a customer who owes you for five different invoices. Without remittance advice, you’d be guessing where that money goes. But with it, you can match each dollar to the right invoice. Some customers send this information in an email, a form, or as part of the payment itself, especially if it’s done electronically. It may seem like a small detail, but remittance advice is incredibly valuable. It reduces errors, prevents disputes, and saves time.

Once the payment is received, it doesn’t just sit there—it needs to be recorded properly. That’s where cash application comes in. Cash application is the process of matching incoming payments to the correct invoices in the accounting system. It’s a bit like a puzzle, but with serious consequences if the pieces don’t match. Applied correctly, it shows which invoices are paid and which are still outstanding. This keeps the books clean and up to date. Accurate cash application also helps with forecasting future income, managing collections, and maintaining customer trust.

But what happens when you receive money and don’t know what it’s for? This is called unapplied cash. It means the money is in your account, but you haven’t matched it to an invoice. Maybe the customer forgot to include remittance advice. Maybe they paid too much, or perhaps they made an advance payment before being invoiced. Whatever the reason, unapplied cash creates a gap. It’s like holding a payment in your hand without knowing where it belongs. While it’s still technically your money, it can’t be fully recognized until it’s tied to an invoice. The longer it sits unapplied, the harder it is to resolve, and it can affect financial reporting or even delay follow-ups on unpaid invoices.

Each of these components—invoice details, credit and debit memos, remittance advice, cash application, and unapplied cash—are like gears in a well-oiled machine. When they work together, businesses get paid faster, records stay clean, and customer relationships remain smooth. But when one part breaks down, everything slows. Payments go missing, invoices go unpaid, and teams spend hours chasing down answers that should’ve been clear from the start.

It’s easy to overlook these terms as just accounting talk, but they carry real-world weight. A clear invoice can mean the difference between a 10-day payment and a 60-day delay. A missing remittance advice can lead to a misapplied payment and a frustrated customer. And a buildup of unapplied cash can turn your financial reports into a guessing game.

This is why understanding the billing and payment process isn’t just a job for accountants. Sales teams, customer service reps, small business owners—anyone involved in getting paid—should understand how these parts work. Even if you don’t deal with the numbers directly, knowing the process helps you communicate better with your team and your customers.

Technology can make this process easier. Many businesses use accounting or ERP software that automates parts of invoicing and cash application. These systems can scan remittance advice, match payments, generate memos, and keep records updated. But even the smartest system still needs people who understand what’s happening behind the scenes. Knowing the terms and their importance helps you troubleshoot when things don’t go as expected.

At its core, this is about making sure that the money you earn actually reaches you—correctly, on time, and without confusion. A little understanding goes a long way. You don’t need to become an accountant overnight, but by learning these simple but powerful terms, you’re already taking a big step toward better business practices. Whether you’re chasing down an unpaid invoice or just trying to make your billing process smoother, these tools and concepts are your allies.

Getting paid shouldn’t be a mystery. With the right knowledge and a bit of organization, you can turn the billing process from a source of stress into a simple, reliable part of your business. And the best part? When everything clicks into place, you free up more time to focus on what matters most—growing your business and serving your customers.